March 2012 IRS Email Scam Alert

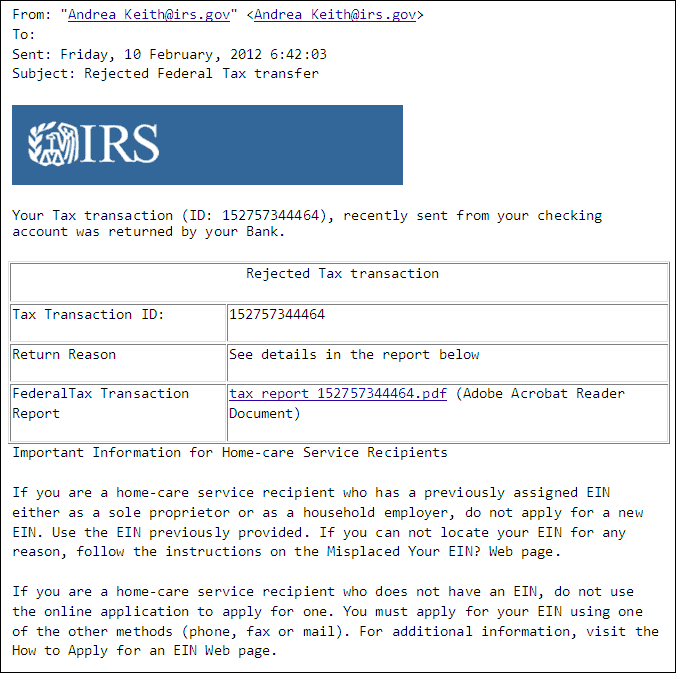

Fraudulent emails, purporting to be from the IRS, may once again be showing up in the email boxes of both companies and individuals during tax season. Below is a sample of a phishing email claiming to be from the IRS. Although it may look authentic, it is not.

It is important to note that the IRS does not initiate contact with taxpayers by email, text message, or social media channels to request personal or financial information.

As is common with these types of phishing emails, the message indicates that your tax transaction was returned by your bank. Included in the information is a link to a report that will allegedly provide more information on the transaction. If you click on the link in the email to access the report, you will download malware onto your computer, which will then be used to steal your information and money.

Other IRS email scams claim your electronically filed tax return was rejected and ask you to correct the error. You are then advised to open the attachment, which contains malware.

What should you do if you receive a suspicious email purporting to be from the IRS?

If you receive a suspicious email:

- Do not open any attachments or click on any links in the email.

- Contact the IRS at 1-800-829-1040 to ask them if they are trying to contact you.

- Forward the email to the IRS at phishing@irs.gov before deleting it.

Tips to help protect you:

Education is your best defense - know what to look for and what to do. To find out more about how to protect yourself from fraud, visit the Fifth Third Bank Privacy & Security Center at www.53.com/security.

Equal Housing Lender

Equal Housing Lender