Take a tour of some of the most exciting new features to Internet Banking for Private Bank clients

Introducing the new Internet Banking for Private Bank clients.

Log in to Internet Banking and you'll notice a fresh new look, a simplified user experience, and powerful new features—all based on extensive client feedback.

New features include:

Balances at a Glance

Now you can quickly and easily view a snapshot of all your Fifth Third balances. You can view your balances as a dollar amount or percentage and even choose which accounts you want included in the display.

Account Drawer

With this new feature, you can see your Recent Activity, Account Statements, Account Details, and even transfer money (based on account type), all within the My Accounts page. If an account has a "+" button next to it, simply click on it to expand the Account Drawer.

My Team

Use the My Team link to see your entire Private Bank Team, including photos, contact information, and bios, all in one convenient place.

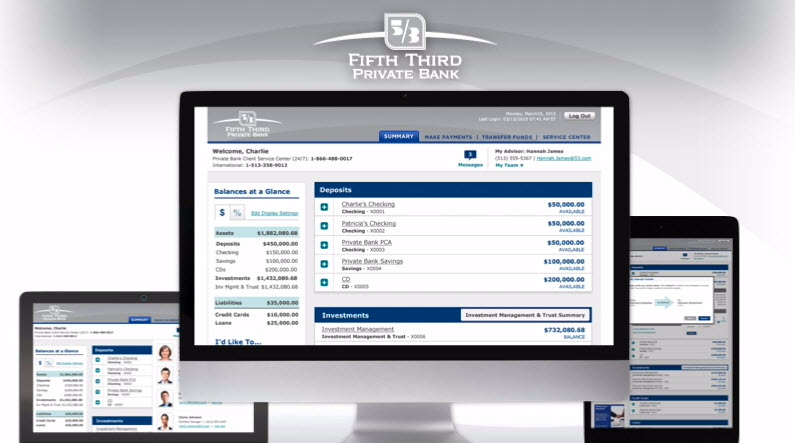

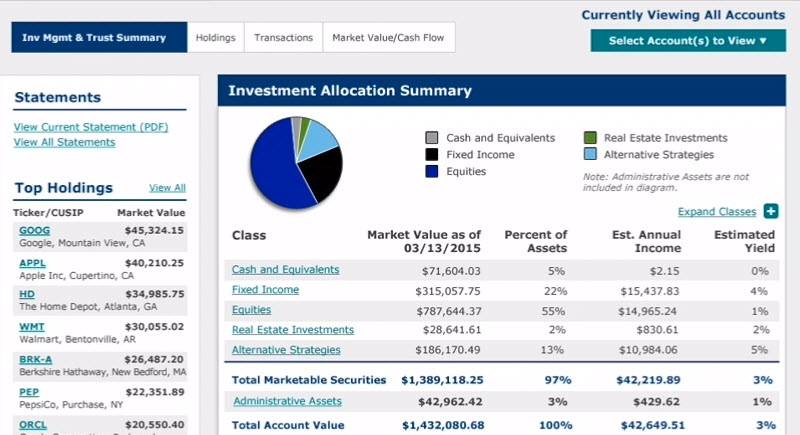

Account Selector

This useful new feature lets you easily switch between all of your Investment Management & Trust accounts. Plus, the Account Selector enables you to create, edit and remove custom grouped accounts—so you can focus on the investment data that's most important to you.

Questions? Contact your Fifth Third Private Bank advisor or call the Private Bank Client Service Center at 1-866-488-0017, 24 hours a day/seven days a week.

Frequently Asked Questions

Click on the question to view the answer.

The Manage My Groups button within Select Account(s) to View enables you to create/edit and remove groups of IM&T accounts.

To create a new group, click create new group which displays all IM&T accounts (by default). The next step to create a group is entering a Group Name. To select accounts to be part of the group, select the checkbox next to the account names and click Save.

To view an existing group, select Manage My Groups and click on the group name within the left navigation. The associated accounts that make up that group will be displayed with a checkmark. You can edit the group by deselecting and selecting the checkboxes next to the account names.

To remove a group, go to Manage My Groups, select the Group to be removed and click on the Remove Group link. This will remove the group from the Account Selector drop down.

The Market Value/Cash Flow tab depicts the change in market value in your account(s) over time as well as any Net Additions or Withdrawals made to or from the account(s) during each time period. Net Additions/Withdrawals made to or from the selected accounts during each time period include: cash contributions, asset additions, cash withdrawals and asset distributions. Not included in Net Additions/Withdrawals: fees, interest/dividends collected, accrued income, rebate of advisory fee, purchases/sales, maturities, stock splits, wash sale adjustments, carry value and tax cost adjustments, income to principal and principal to income transfers, and other income/expenses. Market Value is the year end or prior day (YTD) market value of the selected accounts.

NOTE: Year to Date values are based on information as of the prior business day.

Disclosures

Subject to Internet Banking terms and conditions.

Deposit and credit products provided by Fifth Third Bank. Lending is subject to credit review and approval.

Member FDIC.  Equal Housing Lender.

Equal Housing Lender.

Fifth Third Private Bank is a division of Fifth Third Bank offering banking, investment and insurance products and services. Fifth Third Bancorp provides access to investments and investment services through various subsidiaries, including Fifth Third Securities. Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a registered broker-dealer and registered investment advisor. Registration does not imply a certain level of skill or training.

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not a Deposit | |

Insurance products made available through Fifth Third Insurance Agency, Inc.