Oil: Searching for a Bottom – 2Q15

06/19/2015

After years of crude oil above $100 per barrel, intensive capital investment in energy extraction and rising production caused an imbalance in demand and supply. Extensive supply led to a precipitous decline in oil prices globally, which has pressured some exploration and production to reassess future production plans and to determine whether further extraction could be formidable going forward.

Robust levels of supply are largely a function of production in the U.S., as a result of cost-effective production techniques to extract U.S. shale oil. Oil supply growth increased by 4.3 million barrels per day (MBPD) in the U.S., expanded 1.6 MBPD in Saudi Arabia, and changed little from the remaining 50 oil producing countries from 2009 through 2014. With this data in mind, the price of oil moving forward will have a strong relationship with production in the U.S. and whether demand will accelerate amid lower energy prices.

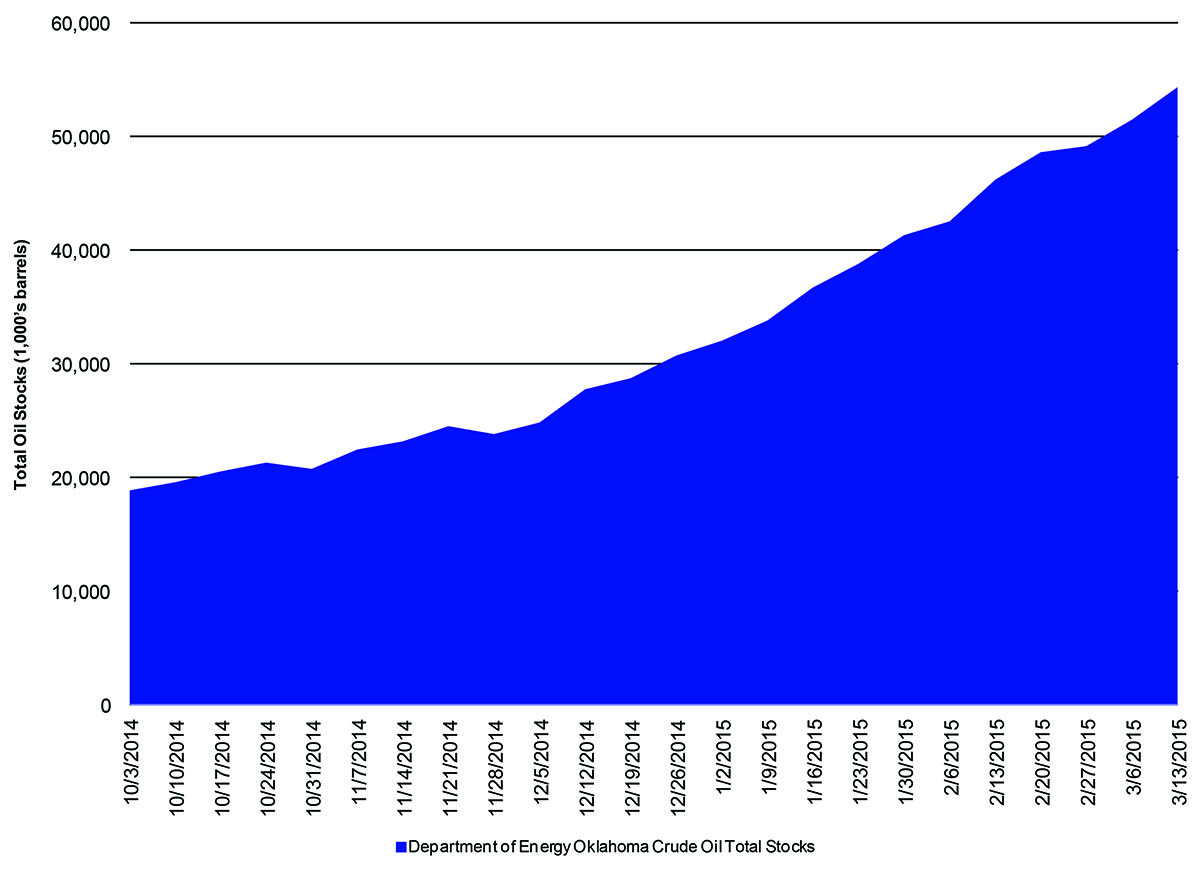

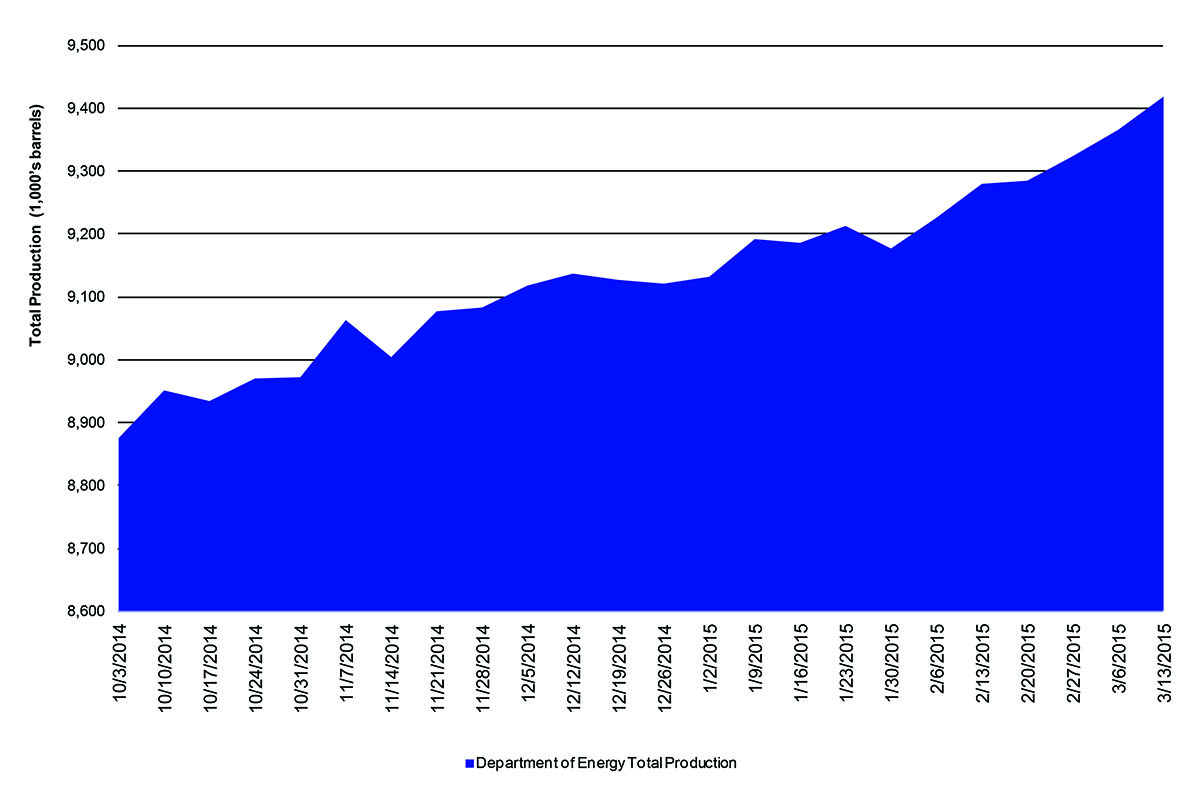

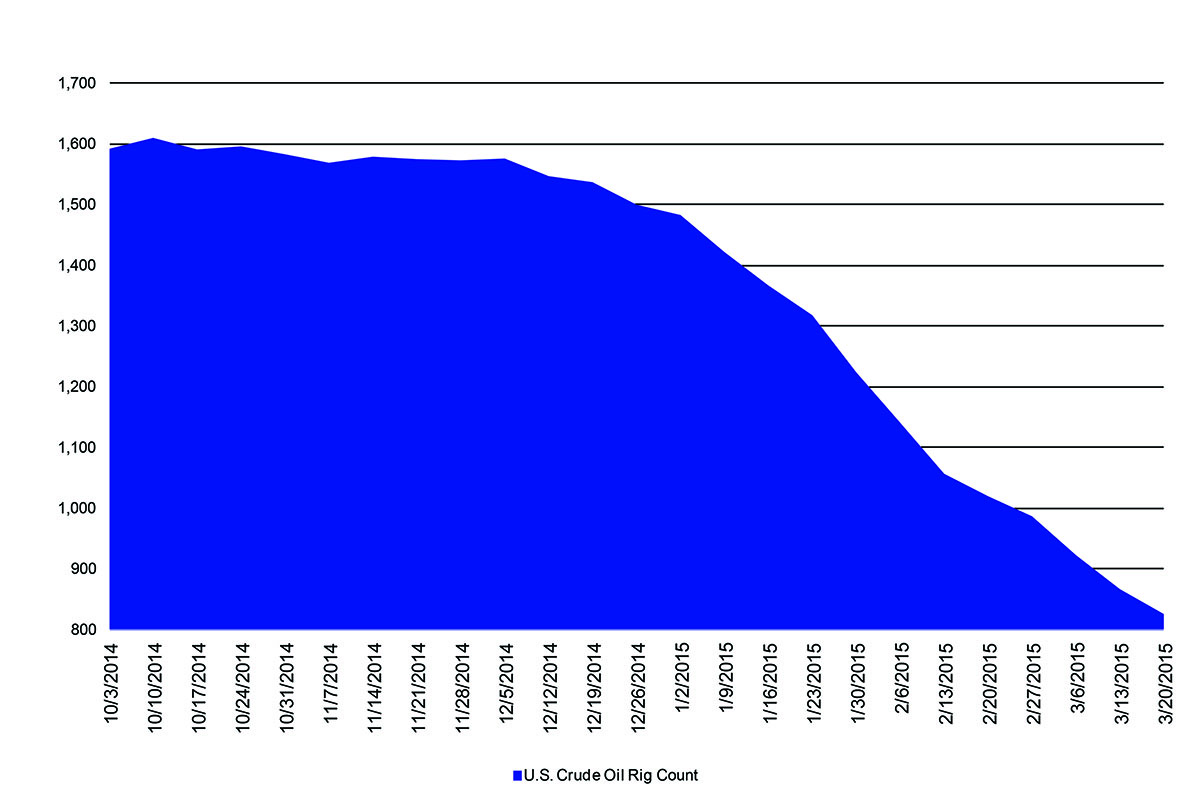

Investors have been following two data sets that provide insight into the condition of the crude oil market: total production and U.S. rig counts. U.S. rigs have declined at a substantial amount since the end of last year, about 50 percent lower. On the other hand, total production continued to increase during the same time period. This is primarily due to cost-ineffective and low production rigs being shut down, rather than those extracting at profitable levels. In the midst of lower levels of production in 2015 compared with 2014, the consensus expects oil demand growth of 1.0 MBPD in 2015, as the global economy improves. While the short-term price of oil is fluctuating in conjunction with the potential capacity in oil inventories (see Crude Oil Stocks graph below), oil prices are poised to drift higher in 2015 alongside further clarity in fundamentals.

Crude Oil Stocks

Source: Bloomberg

Total Production

Source: Bloomberg

U.S. Rig Count

Source: Bloomberg

For more information, please contact your Fifth Third Bank Client Consultant.

View All Articles >

Equal Housing Lender

Equal Housing Lender