Positive Momentum in Europe - 3Q15

Ignited in 2013 through 2014 by a globally-coordinated recovery and extremely accommodative monetary policy, Europe’s economy was poised to gain traction after the global financial crisis and eurozone sovereign debt crisis:

- The Markit Eurozone Manufacturing Purchasing Managers Index (PMI) peaked at 54 in January 2015 (see chart below).

- Eurozone gross domestic product in the fourth quarter of 2014 expanded at a yearly rate of 0.9 percent.

- Industrial activity grew positively on a yearly basis for six straight months, ending in February 2015.

Markit Eurozone Manufacturing PMI

Source: Bank for International Settlements

Not only was activity trending in a positive direction, albeit at a slow pace, but the European Central Bank (ECB) instituted negative interest rates and a substantial quantitative easing program. The ECB cut its deposit rate for banks from zero to -0.1 percent and slashed its benchmark interest rate from 0.2 to 0.15 percent, while also enacting its long-awaited quantitative easing program in early 2015 by purchasing sovereign debt along with private debt. These two programs revived investor demand for risky assets in equity markets, peripheral sovereign debt, and real estate.

The momentum gained over the last two years was modestly interrupted by the recent Greek crisis. Eurozone consumer confidence reversed trend, falling to -5.6 in June from a previous low of -3.7 in March. Also, retail sales declined in February and March, the first time since September 2014. Market participants and citizens of Europe feared the potential default of Greece would lead it to leave the eurozone, setting precedence for other countries with similar debt instabilities and the potential of contagion.

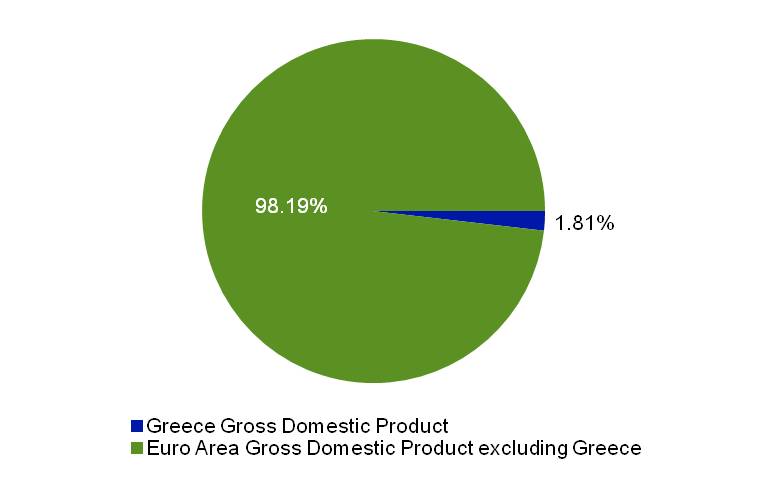

Contagion was certainly a concern in 2011 when the prospect of a Greece default would lead to further uncertainty of other peripheral countries, but Europe today as a whole is much stronger. In addition, Greece is a relatively small component of the European economy, at only about 1.81 percent of the eurozone economy and 0.3 percent of the world economy, as shown below:

GDP Contribution of Greece to Euro Area

Source: Bloomberg

In addition, no single country relies significantly on Greece for its exports: as a percentage of GDP to neighboring Bulgaria, exports total about 3.5 percent. Also, over 80 percent of the $294.9 billion Greek debt is held by the official sector, and foreign claims on Greece have come down substantially to $46.8 billion.

Market participants have largely ignored the threat for a Greek exit from the euro with the MSCI World index only off 2.29 percent on July 14 from its 2015 high, as things are looking up in Europe. The economy has recovered, industrial production is expanding, consumer prices are growing, and real gross domestic product is expected to grow 1.6 percent.

For more information, please contact your Fifth Third Bank Client Consultant.

Fifth Third Bancorp provides access to investments and investment services through various subsidiaries. Investments and Investment Services are not FDIC insured, offer no guarantee, may lose value, are not insured by any federal government agency, and are not a deposit. © 2015 Fifth Third Bank

View Institutional Trends Archive >

Equal Housing Lender

Equal Housing Lender