Account Activity

The Account Activity page presents your current transaction information. Use this page to:

- View your current balance snapshot.

- View pending and posted transactions on your account.

- Search for specific posted transactions using a check number or descriptive keyword.

- View previous account activity by selecting another statement period from the drop-down box.

- Switch between accounts easily by selecting a different account name in the drop-down box.

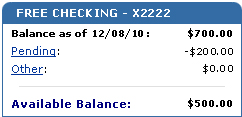

Balance Snapshot

The Account Activity page now offers a balance snapshot for all checking and savings accounts. The snapshot lets you quickly and easily view the balance of your account. Below is an example of what you might see in your balance snapshot.

Balance as of 12/08/10

Your previous business day balance consists of all transactions that have posted to your account. In the example above, the customer has a balance of $700.00 after the close of business on 12/08/10.

Pending

Pending transactions have been authorized but have not yet posted to your account. In the example above, the customer has a total pending transactions of -$200.00.

Other

Other items may affect your overall Available Balance. Examples of other items are:

- Deposited funds being held.

- Bank holds.

Direct Deposit

Direct Deposit reflects pending deposits, such as Social Security and payroll, included in your Available Balance that will post to your account at the end of the current business day. Funds are included in your Available Balance the same day the Bank receives the deposit.

Available Balance

Available Balance reflects funds in your account available for immediate use. In the example above, the customer has an available balance of $500.00.

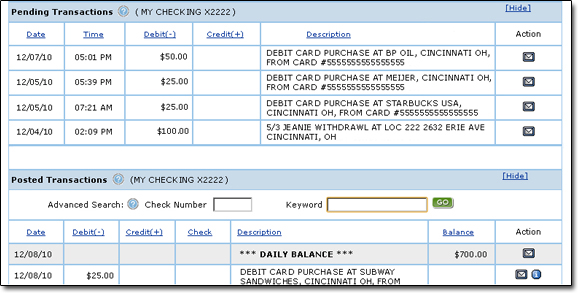

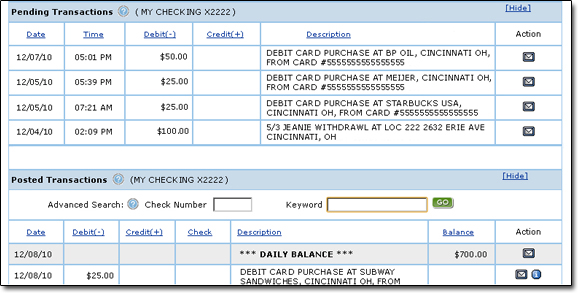

Pending and Posted Transactions

Account Activity

From the Account Activity page—now you can view both your pending and posted transactions for all checking and savings accounts. For your posted and pending transactions, you can:

- Sort the displayed information by clicking on any of the underlined fields (Date, Time, Debit(-), Credit(+), or Description).

- View, print and save front and back images of checks, deposit slips and withdrawal slips by clicking

.

. - Click the check number to view your cleared check(s). NOTE: This only works for check(s) that were not processed electronically.

- Get complete bill payment information when you click

.

.

Pending Transactions

Pending transactions have been authorized but have not yet posted to your account. In some cases, the amount of the pending transaction may not match the actual amount of the transaction. Some merchants, including gas stations, restaurants, airlines, and hotels, will place an initial hold (known as an "authorization") on the account for a dollar amount that could be higher or lower than the transaction. This authorization is placed by the merchant to ensure that you have enough funds in your account and is removed once the transaction has either posted to your account or is cancelled.

Typically, transactions made with your debit card using a PIN are processed and posted to your account on the same day the transaction is made. Signature based transactions made with your debit card can take 1 - 3 business days to post.

At times, you may see pending transactions for the same amount from the same merchant. These authorizations are originated by the merchant, but may not actually post to your account. For example, a merchant may accidentally swipe your card twice resulting in two authorizations. Your available balance will be impacted by both authorizations, but the funds will be added back to your available balance once the authorization expires, or is removed by the Bank the following day at your request.

Examples of pending transactions include:

- Debit Card Authorizations

- Deposits and Withdrawals at ATMs

- Transactions Performed at a Banking Center

- Internet Banking Transfers and Bill Payments

- Jeanie® Telephone Banking Transactions

- Incoming and Outgoing Wire Transfers

As you perform these transactions throughout the day, the amount of the pending transaction changes your available balance. Below is an example of a debit card purchase compared to a deposit to show how your balance changes:

| Beginning Balance Today $500Daily Balance $500Available Balance Today you make a $100 purchase with your Fifth Third Debit MasterCard® New Balances Today $500Daily Balance $400Available Balance |

Beginning Balance Today $500Daily Balance $500Available Balance Today you make a $200 cash deposit at a Banking Center. New Balances Today $500Daily Balance $700Available Balance |

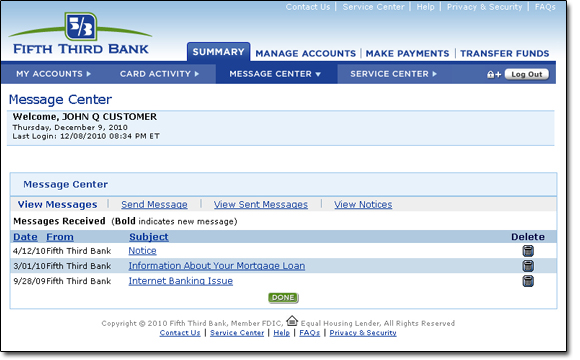

Overdraft Notification

If an overdraft occurs on your account, a notice is mailed to you and is available on Internet Banking in the Posted Transaction area of your Account Activity page. The new overdraft notice features a daily statement that provides a reconciliation from the previous day’s balance to show how your balance changed from one day to the next, and why you are overdrawn. Also, details of Posted and Pending Transactions that comprise your balance are shown.

When an overdraft occurs and the letter is mailed, a new overdraft indicator ![]() will display in the Posted Transactions section of the Account Activity page. Select the

will display in the Posted Transactions section of the Account Activity page. Select the ![]() to view a PDF version of the overdraft notice that was sent to you.

to view a PDF version of the overdraft notice that was sent to you.

You can also access a copy of your overdraft notice by selecting the View Notices link within the Internet Banking Message Center.

Fifth Third is licensed by DTC under U.S. Patent Nos. 5,910,988 and 6,032,137.