Home Equity Line of Credit Loans

Fifth Third Equity FlexlineSM1 is a revolving credit line that is secured by the equity in your home—the difference between the appraised or market value of your home and the amount of your outstanding mortgage balance.

How does a home equity line of credit (HELOC) work?

With the Fifth Third Equity Flexline, you can borrow against the equity in your home at competitive home equity credit line rates. As you repay the HELOC balance, funds become available again for your use. Plus the interest you pay may be 100% tax deductible.3

Use a home equity credit line to:

Other exclusive home equity line of credit benefits:

Fifth Third Equity Flexline Platinum MasterCard

Access your home equity line anytime, anywhere with your Fifth Third Equity Flexline Platinum MasterCard. Make purchases over the phone, online or wherever MasterCard is accepted, or withdraw cash at any ATM. Transactions are subject to the same terms and conditions as your Fifth Third Equity Flexline agreement.

Fifth Third Rewards is available on the Fifth Third Equity Flexline MasterCard! Enrollment is free and automatic when you activate your Fifth Third Equity Flexline MasterCard. Plus, you will receive 5,300 bonus points with your first signature card usage. Please visit Fifth Third Rewards for more information.

Fixed Rate Lock Option on Home Equity Credit Lines

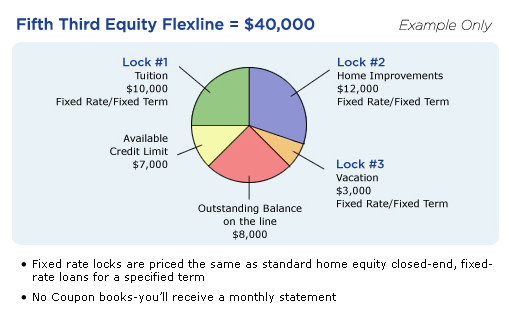

Combine the flexibility of a variable rate home equity line of credit with the security of a fixed rate loan. At any time, you may lock in the current installment loan rate on the outstanding balance of your Fifth Third Equity Flexline, which means fixed rate, fixed term, and fixed payments. Take up to three separate "locks" on your Fifth Third Equity Flexline at the same time, as in the example below.

To apply for a Fifth Third Equity Flexline or to increase your Fifth Third Equity Flexline, call toll free at 1-866-53-LOANS, or fill out a secure online application.

View our application checklist to see what you will need to apply.

Account Management Services

Want to learn more about managing your money more carefully? Learn how Account Management Services can help.

Disclosures

- Loans are subject to credit review and approval.

- ATM and PIN-based transactions do not qualify for Rewards points.

- Consult tax advisor regarding deductibility of interest.

*Please review the Equity Rate Disclosures (PDF)