Education Planning

College Savings Accounts to Help Your Child Succeed

You encourage good study habits, tell your children to pace themselves and plan ahead. That same strategy can help you finance your loved one's college education with college savings accounts.

According to The College Board, higher education results in greater earnings, and in many other respects improves people's lives. College-educated adults are more likely than others to receive health insurance, lead healthier lifestyles, are more active citizens and engage in more education activities with their own children. However, college tuition and fees have skyrocketed over the last 20 years. Today, it costs an average of just under $70,000 for a 4-year public in-state college degree and $160,000 for a 4-year private college education. And the cost of a college education is predicted to continue to rise. In 2020, the projected total cost of a 4-year in-state college education is expected to be $113,314 while the projected total cost of a 4-year private college education is projected to be $259,718.1

Fifth Third Securities would like to help you achieve your education savings goal. An Investment Professional can help you identify appropriate tax-advantaged college savings accounts, such as a 529 college fund2, taking into consideration the number of years until graduation, to help you reach your goal.

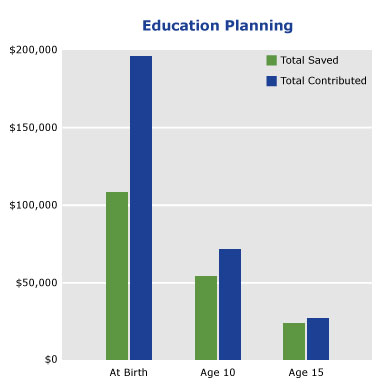

In the example below, all three sets of parents save $500 per month for their only child to pay for college when their child enrolls in their 19th year. The difference is that Parents 1 begin saving at the birth of their child, Parents 2 when their child reaches age 10, and Parents 3 when the child turns 15.

It pays to plan ahead and open a college savings account to start saving early.

This is a hypothetical example which assumes an annual rate of return on savings of 6% for illustrative purposes only and is not a guarantee of future results.

If your child is getting ready for college, our college guide offers financial aid information for students and parents.

Before investing, investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other benefits that are only available for investments in such state's qualified tuition program. 529 Plans may be subject to certain restrictions. By investing in a Plan outside of your state of residence, you may lose any state tax benefits. Non-qualified withdrawals are subject to federal and state income tax and a 10% penalty.

Investors should consider the funds investment objective, risks, sales charges, expenses, and ongoing fees carefully before investing or sending money. This and other important information about municipal fund securities, including 529 plans, can be found in the issuer’s official statement. To obtain an official statement, please ask your Investment Professional. Please read the official statement carefully before investing.

Get Advice and Guidance

When you seek investment strategies to support your personal investment plan, contact a Fifth Third Securities Investment Professional, visit a Fifth Third Banking Center near you, call us toll free at 1-800-416-8714, or fill out a contact form.

- Source: The College Board. Tuition and Fee and Room and Board Total Charges, 2010 – 2011, Table 1a: Average Published Charges for Undergraduates by Type and Control of Institution, 2010-11. Trends in College Pricing.

Copyright © 2010 The College Board. www.collegeboard.com. Projection assumes a 5% expected annual increase in education expenses.

- 529 Plans are subject to enrollment, maintenance, administrative and management fees and expenses. Plans are sold by a program description, which includes a description of the fees and expenses that apply to an investment in the 529 Plan. Please read the prospectuses, Participant Agreement and Disclosure Statement carefully before investing. 529 plans are subject to market risk and may be worth more or less than the original investment. 529 Plans may be subject to certain restrictions.

Fifth Third Securities does not provide tax advice. Please consult your tax advisor before making any decisions or taking any action based on this information.

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a broker-dealer and an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Fifth Third Securities is a wholly owned subsidiary of Fifth Third Bank. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through

Fifth Third Insurance Agency, Inc. | Business Continuity