Staying on Track

Personal Retirement Planning and Investing

Markets move, jobs change, life happens, which makes it important to keep abreast of your retirement savings strategy. We can help you identify investments that may meet your personal retirement planning needs and help you revisit your plan regularly to help ensure you have a strategy that remains appropriate for your situation.

Have you already started saving for retirement? Are you investing in the best types of retirement plans for you and making the most of your 401(k) plan at work? Even if you think you are doing everything right, circumstances may change and it is best to make sure you are still on track. As a starting point, you can use our Retirement Calculator to help answer some of your personal retirement planning questions, such as whether or not you are saving enough, and how much you can contribute to your retirement plan each year.

In addition, an Investment Professional at Fifth Third Securities can assist you by helping to determine whether your asset allocation strategy is still appropriate for your current situation, as well as recommending types of retirement plans that may be suitable for you.

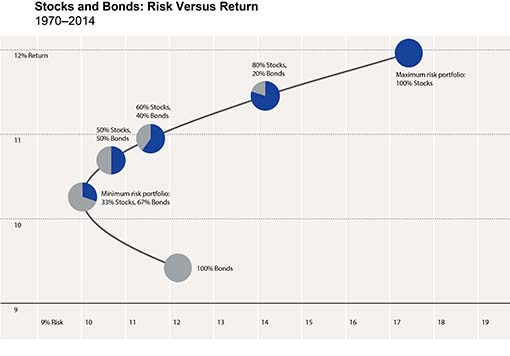

The graph below shows different combinations of assets and the historical risk and return associated with each. As you can see, the least risky portfolio is not the portfolio entirely comprised of bonds. In fact, a diversified portfolio of stocks and bonds can reduce anticipated portfolio risk, since stocks and bonds are not highly correlated. This means that market conditions that move stock prices up may move bond returns down and vice versa, and this offsetting movement can reduce overall portfolio risk.

Your asset allocation strategy is an integral component of your personal retirement planning and can help you stay on track.

Stocks in this example are represented by the Ibbotson® Large Company Stock Index, and bonds by the 20-year U.S. government bond. Risk and return are based on annual data over the period 1970–2014 and are measured by standard deviation and arithmetic mean, respectively. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs.

© 2015 Morningstar. All Rights Reserved. 3/1/2015

Get Advice and Guidance

To learn about different types of retirement plans that may be right for your personal retirement planning needs, contact a Fifth Third Securities Investment Professional, visit a Fifth Third Banking Center near you, call us toll free at 1-800-416-8714, or fill out a contact form.

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a broker-dealer and an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Fifth Third Securities is a wholly owned subsidiary of Fifth Third Bank. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through

Fifth Third Insurance Agency, Inc. | Business Continuity