Making it Last

Preparing to Have the Money Needed for Retirement

The last thing you want to worry about is outliving your savings. You need an investment strategy that supports your retirement income needs and strategies for stretching retirement savings that can help you take control of your retirement.

Why is Retirement Income so Important?

For many retirees, one of the most pressing concerns is correctly estimating the amount of money needed for retirement and developing investment strategies to make their money last. An Investment Professional at Fifth Third Securities can help you calculate the money needed for retirement and recommend an investment and withdrawal strategy to help make your money last.

Did You Know?

There are many factors that affect how long your savings will last, such as:

The consumer price index rose 64% from the end of 1990 to the end of 2010. This means that someone who retired 20 years ago has seen their purchasing power decrease significantly over the course of their retirement.1

Various types of investments react differently under similar market conditions. A Fifth Third Securities Investment Professional can help you create an investment portfolio that may be appropriate for your investment needs, whether you seek a possible greater return or prefer minimum risk.

The more slowly you draw down your funds, the longer your savings will last.

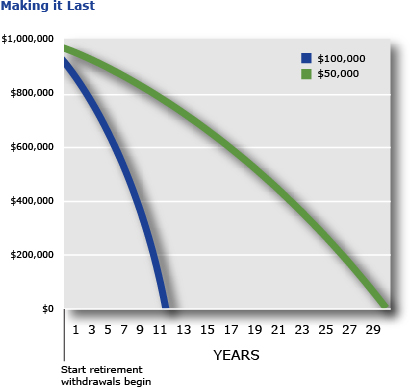

Your Withdrawal Strategy Affects How Long Your Savings May Last

The number of years your retirement savings will last depends on how much you take out each year. The chart, below, illustrates this point by showing the experience of two hypothetical retirees. The retiree shown in blue leaves the work force at age 60 with $1,000,000 in savings. Each year in retirement he takes out $100,000 for living expenses. As the chart shows, by the time he is 72 he has exhausted his savings. The retiree shown in green also leaves the work force at age 60 with $1,000,000 in savings but he takes out only $50,000 a year. He does not run out of savings until he reaches 90 years old.

This is a hypothetical example which assumes that each person invests in 5% return municipal bonds with a consumer price index (CPI) rising at 2% a year effectively leaving a 3% per year appreciation rate on investments. This example is for illustrative purposes only and is not a guarantee of future results. Actual results may vary.

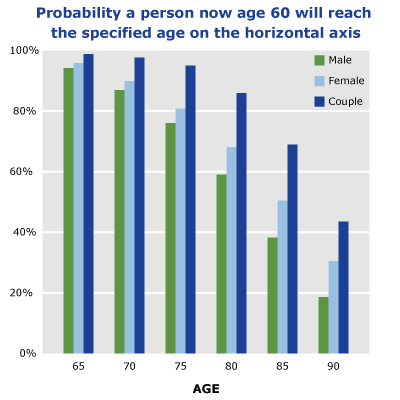

Over the years, the average person's life expectancy has continued to rise. In fact, for a married couple currently age 60, there is greater than a 40% chance that one person will live until 90 years of age.2

People are living longer in retirement making it necessary to plan for their retirement savings to last longer as well.

The table, above, shows the rising probabilities for those reaching retirement age to live well beyond age 65. The percentages shown indicate the probability that a male, female or one member of a married couple who are now age 60 will reach the age designated on the horizontal axis of the chart.3

Do you need your retirement savings to generate income? We can help support your retirement income needs by helping you find income producing investments. Do you want to help protect your nest egg from market swings? We can help you design an asset allocation strategy around your risk and return preferences. We can also help you determine whether Long-Term Care Insurance4 makes sense for you.

Get Advice and Guidance

Take charge of your retirement to help make sure your savings will last with a retirement analysis from an Investment Professional. Find a Fifth Third Securities Investment Professional, visit a Fifth Third Banking Center near you, call us toll free at 1-800-416-8714, or fill out a secure contact form.

- Source: U.S. Government Bureau of Labor Statistics

- Source: The Society of Actuaries, Annuity 2000 Basic Mortality Table

- Source: Annuity 2000 Basic Mortality Table, Society of Actuaries

- Long-Term Care Insurance and other insurance products made available through Fifth Third Insurance Agency, Inc.

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a broker-dealer and an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Fifth Third Securities is a wholly owned subsidiary of Fifth Third Bank. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through

Fifth Third Insurance Agency, Inc. | Business Continuity