529 College Plans and Other Education Strategies

Tax-advantaged Educational Savings Programs

You want to be sure your loved ones can enjoy the benefits of a college education, but the costs continue to rise. Educational savings accounts, such as 529 college plans†, UGMA or UTMA custodial accounts can help provide a way to save for your loved one's future. They can offer special tax advantages1 that help participants make the most of their savings potential.

There are two types of 529 plans2 to choose from:

- A 529 Prepaid Tuition Plan gives you the option to prepay for college at today's lower costs.

- A 529 College Savings Plan allows you to invest in your choice of professionally managed investment options. They provide the potential for tax-free growth and distributions for the beneficiary.

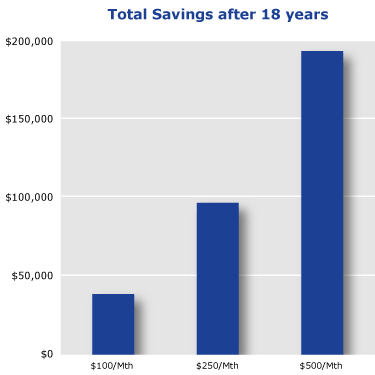

You would be surprised at how contributing even small amounts at a time can really add up, especially when your savings are in potentially tax-advantaged educational savings programs such as the 529 college plan. Incremental savings can also really make a difference. As you can see in the chart, below, putting away a little more each month for your child's education can add up to significantly greater savings when your child is ready for college.

The total investments of three parents who saved different amounts each month from their child's birth to the day the child turned 18. Investments were made at 6.00% annual rate of return compounded monthly.

A Fifth Third Securities Investment Professional can assist you with setting up 529 college plans as well as UGMA and UTMA custodial accounts. Learn more about the importance of education planning.

†Before investing, investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other benefits that are only available for investments in such state's qualified tuition program.

529 plans may be subject to certain restrictions. By investing in a plan outside your state of residence, you may lose any state tax benefits. Non-qualified withdrawals are subject to federal and state income tax and a 10% penalty.

Investors should consider the funds investment objective, risks, sales charges, expenses, and ongoing fees carefully before investing or sending money. This and other important information about municipal fund securities, including 529 plans, can be found in the issuer's official statement, please ask your investment professional. Please read the official statement carefully before investing.

Get Advice and Guidance

For more information, contact a Fifth Third Securities Investment Professional, visit a Fifth Third Banking Center near you, call us toll free at 1-800-416-8714, or fill out a contact form.

- Fifth Third Securities does not provide tax advice. Please consult your tax advisor before making any decisions or taking any action based on this information.

- 529 plans are subject to enrollment, maintenance, administrative and management fees and expenses. Plans are sold by a program description, which includes a description of the fees and expenses that apply to an investment in the 529 plan. Please read the prospectuses, Participant Agreement and Disclosure Statement carefully before investing.

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a broker-dealer and an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Fifth Third Securities is a wholly owned subsidiary of Fifth Third Bank. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through

Fifth Third Insurance Agency, Inc. | Business Continuity

Retirement Savings

Are you on track to save enough for retirement? We offer IRAs that help you work toward your retirement goals.

Personal Insurance

Protect your family's financial security from the unexpected with a range of insurance strategies.