Homeowner Plus Value Package

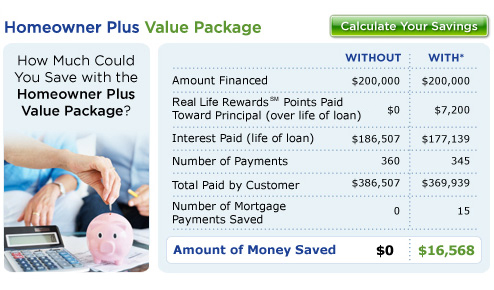

Saving money wherever and whenever you can is important to every homeowner. That's why we've combined three essential financial tools – a Fifth Third mortgage loan1, a Fifth Third Consumer Rewards Credit Card2 and the Fifth Third Established Checking Account3 – to help you save on your everyday banking and help pay off your mortgage sooner.

The Three Financial Tools

Fifth Third Mortgage1

At Fifth Third, we're dedicated to help you find the right mortgage loan for your needs from our wide variety of mortgage types and financing options. Our Mortgage Loan Originators are here to listen to your specific needs and answer any and all questions you may have, every step of the way. Let us help you open the door to your dream home.

Fifth Third Consumer Rewards Credit Card2

A Fifth Third Consumer Rewards Credit Card helps you pay down your Fifth Third Mortgage faster by turning everyday purchases4,5 into Real Life RewardsSM points that can be used to pay down your mortgage principal. Every time you reach 2,500 Real Life Rewards points, you can redeem your points for a $25 principal reduction to your Fifth Third Mortgage.6 Click below to learn more about the Fifth Third Real Life Rewards Program.

Fifth Third Established Checking3

Our Fifth Third Established Checking Account is designed with special benefits for customers who have a mortgage loan with us. Plus, act now and receive an estimated $1,000 savings (1/2 discount point) if you have your Fifth Third Mortgage payments automatically deducted from your Fifth Third checking account.7 This account offers complimentary Fifth Third Identity Recovery Assistance8, better rates on CDs and relationship interest rates on Fifth Third Relationship Money Market accounts.9 As with this account, all of our checking accounts offer direct deposit, a debit card, Online Banking and Bill Payment, and mobile banking and text alerts.10 For our Established Checking Account customers, the monthly service charge of $15.00 can be waived with either an existing Fifth Third personal mortgage or spend at least $500 per month on a Fifth Third Credit Card.11

*Example assumes a 5% interest rate (5.059% APR) on a 30-year fixed-rate mortgage of $200,000 with average fees of $1,347.00 (other fees not affecting the APR may apply). This example also assumes average monthly spending, using a Real Life RewardsSM Credit Card, Cash Rewards Card, Columbus Zoo Credit Card or a Nashville Predators Credit Card, of $300/month on gas and grocery purchases and average monthly spending for all other credit card purchases2,4,5 to be $1,500/month and monthly redemption of points.6 A 25% down payment with no private mortgage insurance (PMI) is assumed, with a monthly payment of $1,073.64.

- Loans are subject to credit review and approval.

- Credit Cards subject to credit review and approval. Eligible Consumer Rewards Credit Cards include the Real Life RewardsSM Credit Card, Cash Rewards Card, Columbus Zoo Credit Card and the Nashville Predators Credit Card. Other Fifth Third Consumer Rewards Cards are eligible but point calculation shown in illustration may vary.

- $50 minimum deposit required to open a checking account. Checking accounts may have monthly fees.

- Purchases are defined as the dollar value of goods and services of credit purchases made with the Card, minus any credits, returns or other adjustments as reflected on the monthly statements. Purchases do not include annual fees, late payment fees, over-limit fees, insurance charges, card-related service charges, Finance Charges, or other fees and/or unauthorized charges. Purchases also do not include Cash Advances, PIN-based transactions, Ready Reserve Overdraft Protection transactions, balance transfers, Convenience Checks, person-to-person money transfers, quasi-cash transactions (including the purchase of casino gaming chips, lottery tickets, wire transfer services, traveler's checks, foreign currency, or money orders), gaming transactions or currency purchases. Some products may carry an expiration limit on rewards points. Refer to the Rewards Program Terms and Conditions which can be found by signing into Internet Banking at 53.com.

- Applies to Real Life Rewards, Columbus Zoo and Nashville Predators Cards: Everyday Spend Bonus is defined as: earn double Real Life RewardsSM points for every $1 spent on qualifying gas, grocery, and discount store purchases. Fifth Third does not determine the Merchant Category Codes that businesses use to classify their business. Purchases made at a merchant that does not process transactions under the bonus categories will not qualify and you will not receive the Spend Bonus Points. Bonus points will show up on your monthly statement.

Applies to the Cash Rewards Card: Cash Rewards Everyday Bonus is defined as: earn double Real Life RewardsSM for every $1 spent on qualifying gas, grocery and discount store purchases. Fifth Third does not determine the Merchant Category Codes that businesses use to classify their business. Purchases made at a merchant that does not process transactions under the bonus categories will not qualify and you will not receive the Everyday Bonus Points. Bonus points will show up on your monthly statement. Cash Rewards accounts earn a 2% cash reward for every $1 spent on Everyday Bonus purchases on up to $1,500.00 of eligible Everyday Bonus each calendar quarter. Earn 1% cash reward on Everyday Bonus purchases each calendar quarter over $1,500.00. - Log into Internet Banking on 53.com and click on the Real Life Rewards link to manage and redeem points. Subject to Internet Banking and Bill Pay User Agreement. Redemption for a mortgage loan reward does not replace your monthly payment. Restrictions apply. Subject to Real Life Rewards Terms and Conditions.

- Fifth Third Auto BillPayer discount includes one half (1/2) discount point if you participate in our automatic payment program which can be used to buy down your interest rate. This adds up to a savings of $1,000 based on a $200,000 loan. This discount will be shown at the time of your loan application and will be applied at closing based on final mortgage amount. Terms and conditions are subject to change without notice, including automatic payment program discount, and require automatic payment deduction from your qualifying Fifth Third account. $50 minimum deposit to open new account.

- The Identity Theft Insurance benefits are provided to all members, along with all other benefits afforded as part of the program, through Financial Services Association (“FSA” or the "Association"). Upon enrollment in the program, you will automatically be admitted as a member of the Association.

The Identity Theft Insurance is underwritten by insurance company subsidiaries or affiliates of American International Group, Inc. (collectively, the "Company") under group policy # 7077733 for non-New York State Insureds and # 1423212 for New York State Insureds. The Benefit Summary under the master policy issued by the Company with respect to such insurance will be available to you upon enrollment in the program. The summary of policy benefits, terms, conditions, exclusions, and limits of coverage set forth in the Benefit Summary are subject to the terms of the master policy. Availability of coverage is subject to underwriting qualifications and state laws and regulations. Coverage is subject to actual policy language. - All owners on the savings accounts and any secondary checking accounts must also be listed together as owners on your Fifth Third Established account.

- Mobile Internet data and text message charges may apply. Please contact your mobile service provider for details. Subject to internet banking terms and conditions.

- All owners on a Fifth Third Established Account must also be listed together as owners of the loan. The $500 monthly credit card spend is calculated by looking at all your Fifth Third Credit Card accounts and adding the total amount spent on any personal credit card statement(s) issued within the last 35 days. All owners of the Fifth Third Established Checking account must also be owners or co-applicants or authorized users of the credit card. Bond or lot loans and overdraft lines of credit are excluded. Go to 53.com/personal-banking/checking/established.html for additional information on this account.

Real Life Rewards is a registered service mark of Fifth Third Bancorp.

Fifth Third Mortgage Company, 5001 Kingsley Drive, Cincinnati, OH 45227, 1-877-841-7511, an Illinois Residential Mortgage Licensee, License No. MB 0005994, Illinois Commissioner of Banks and Real Estate, 122 S. Michigan Ave., 19th Floor, Chicago, IL 60603, (312) 793-3000. Fifth Third Mortgage Company d/b/a Fifth Third Mortgage Company Incorporated and licensed by the New Hampshire banking department, licensed by the N.J. Department of Banking and Insurances and the California Department of Business Oversight under the California Residential Mortgage Lending Act. Fifth Third Mortgage is the trade name used by the Fifth Third Mortgage Company (NMLS #134100) and Fifth Third Mortgage-MI, LLC (#447141).