Setting and Sticking to a Budget

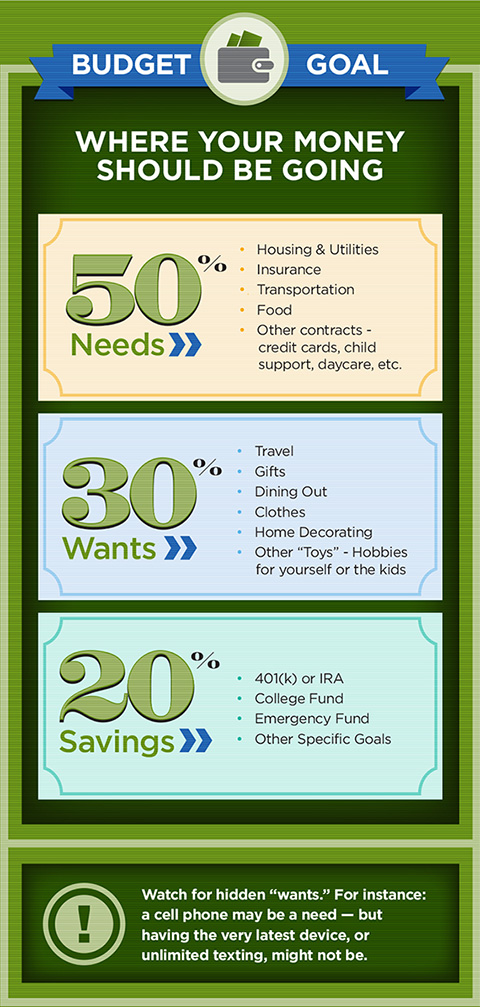

If you've already taken the first steps toward budgeting, you're ready to get into the details. Once you've reviewed your spending habits and recorded your usual monthly income using our free budget worksheet, you may need to realign your spending.

If your expenses don't fall within the percentages above, think about ways to adjust. It's relatively easy to cut down on your wants, for instance, and put that money toward reducing debt instead.

Cutting your needs can require some extra creativity since these are essential items, but there may be options. For instance, if your needs currently take up more than 50% of your monthly income:

- Consider a smaller apartment.

- Consider refinancing your mortgage or car loan. Use our calculator to see possible advantages.

- Talk to your insurance agent about ways to lower your rates.

- Plan your meals one week at a time, and buy only the ingredients you need. Stick to your list when shopping. If possible, base your meal plan on your store's weekly advertised sales. Many stores post their circulars online so you don't have to make a special trip to pick them up.

Tips for Sticking to Your Budget:

- Schedule automatic payroll deductions (or automatic bank account transfers) for your investment savings. Once you get used to living on the remainder, you won't miss it—but you'll be glad you did it when it's time to retire.

- Set limits for spending, particularly in your "wants" category. Then, each time you spend money on these things, subtract that amount from your limit and keep a running total of how much more you can use that month. Our budget worksheet can help.

- Similarly, you can consider using cash for your "wants"—so that when you run out, you'll know you're done for the month.

- When you see something you want in a store, sleep on it. If the item still matters to you the next day, and it's worth going back for, you can.

- Research your purchases. Read customer reviews online, seek out local deals or individuals who are re-selling the things you need. And remember: Sometimes it's less expensive in the long run to buy an item of higher quality.

When you've become accustomed to managing your new budget, you can take the next step, and set bigger goals to save for larger purchases. Or, make a bigger dent in your debt.

This information is intended for educational purposes only. Please contact a professional for additional advice.

Equal Housing Lender

Equal Housing Lender