Starting Off

Retirement Investment Strategies for Your Future

We understand that you need to balance your retirement savings with your current financial needs. Although your retirement may seem like it is far off in the future, your discipline and savings today along with your retirement investment strategies can have a significant impact on how much you will have when it is time to retire. That is because the sooner you begin putting money aside for retirement, the longer your savings may grow, and grow and grow...

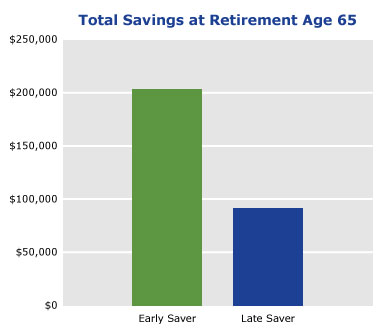

The above example illustrates this point by showing two individuals who took different approaches to saving for retirement. The Early Saver put away $250 per month starting when he was age 25. After he put in a total of $60,000, he stopped adding to his account. The Late Saver put away $250 in his account each month starting 20 years later when he was 45. He contributed $60,000 in total also after 20 years. Both put their money into similar investments which returned 4.00% annually, compounded monthly.

Both retired at age 65. The Late Saver retired with $91,694. The Early Saver saved much more, $203,797.

This is a hypothetical example which assumes a 4% annual return. This example is for illustrative purposes only and is not a guarantee of future results. Actual results may vary.

If you would like a quick check on how you are doing, you can use Fifth Third's Retirement Planning Calculator, which provides answers to your questions about retirement planning, such as:

- Am I saving enough?

- How much can I contribute to my retirement plan each year?

- Should I convert my IRA into a Roth IRA?

Disclosures

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a wholly owned subsidiary of Fifth Third Bank, a registered broker-dealer, and a registered investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through Fifth Third Insurance Agency, Inc.

Investments, variable annuities and brokerage accounts are offered through Fifth Third Securities, a wholly owned subsidiary of Fifth Third Bank. Fixed annuities are offered through Fifth Third Insurance Agency Inc., a wholly-owned subsidiary of Fifth Third Bank.