Fifth Third Overdraft Coverage

Overdraft Coverage allows a payment to be made even if you don't have enough money in your account1. Fifth Third extends standard Overdraft Coverage automatically to eligible accounts4 to help cover the following types of payments:

Benefits of Standard Overdraft Coverage

With standard Overdraft Coverage, you can avoid returned checks and associated fees as a result of returned payments.

Overdraft Coverage Options

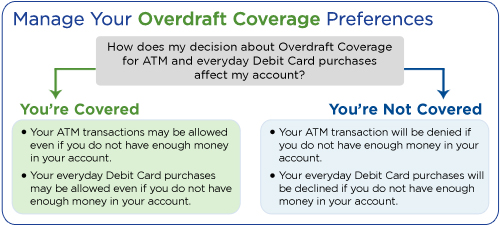

Overdraft Coverage can also be used to cover other types of transactions. View our Overdraft Coverage Tutorial. Make your choice and inform us if you want to receive Overdraft Coverage for the following transactions:

Examples of how Overdraft Coverage may be used to cover ATM transactions and Debit Card purchases:

Your available balance is $50. You attempt to make a $60 ATM withdrawal.

Your available balance is $50. You attempt to buy $60 worth of groceries using your debit card.

How Much Does Overdraft Coverage Cost If I Use The Service?

There are no daily overdraft fees.

If Overdraft Coverage is used, the per item fees are as follows:

Also, we think everyone should have some protection from an occasional shortfall. That's why you're never charged a per item overdraft fee when your account is overdrawn by $5 or less at the end of our business day.

Have More Questions About Overdraft Coverage?

View our Account Management Services online tutorial or FAQs or visit a Fifth Third Banking Center. Log into Internet Banking and make your choice about Overdraft Coverage for ATM and everyday Debit Card transactions.

The Overdraft Coverage amount is subject to change and may be reduced without prior notice.

- Any debits to your account including writing checks, withdrawing money at the bank or ATM, ACH transactions, or other electronic means may result in your account being overdrawn and a fee being imposed.

- Most personal checking accounts offer Overdraft Coverage.

- Everyday debit card purchases are defined as one-time debit card purchases and do not include recurring debit card payments – regularly scheduled electronic bill payments through your debit card account number.

- Overdraft payments are discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your accounts is not in good standing, or you are not making regular deposits, or you have too many overdrafts.