Balance Builder Package

Start a savings plan today and help achieve your financial goals.

Best For You If…

You want a smart way to start saving by setting aside cash, a little at a time, for emergencies or future purchases – without monthly service fees or minimum balance requirements.

Because You Get:

Fees associated with a Balance Builder Package

We'll waive the monthly service fee1 when you:

OR

OR

Perform any combination of five or more of the following checking activities:

Otherwise, a $7.50 monthly service fee will apply.

Apply for a Fifth Third Balance Builder Checking Package

The simple online application process should take approximately 15 minutes to complete. Read the Application Checklist for an overview of the application and what you will need to apply.

It's Easy to Switch to a Fifth Third Balance Builder Checking Account

Open a Fifth Third Balance Builder Checking Account, and then simply download, print and complete these forms:

Fees

Special fees that apply to all checking accounts:* Effective June 27, 2012, fees for all agent-assisted balance transfers and early account closure will be eliminated. For savings accounts, fees for excess withdrawals will also be discontinued.

Disclosures

- Qualifying transactions to waive $7.50 monthly service fee: One (1) direct deposit of $100.00 or more received in the previous 35 calendar days; or your Fifth Third checking account must have (i) one (1) automatic checking transfer of $100.00 or more into a Fifth Third personal savings account during the previous 35 calendar days; AND (ii) total net transfers from your checking to savings during the previous 35 days equal $100 or more; Or any combination of five (5) or more of the following checking activities in the previous 35 calendar days: Debit card purchases (signature or PIN); cleared check(s); Online bill payments done through www.53.com and/or Fifth Third Telephone Banking.

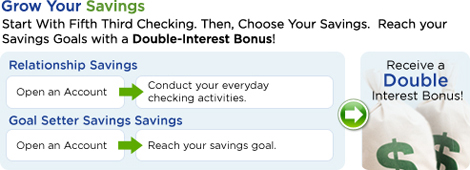

- Relationship Savings Interest Bonus (Double Interest Bonus): Open a Relationship Savings account with a Fifth Third checking account, or link a new Relationship Savings to an existing active Fifth Third checking account, and your Relationship Savings account will receive the Double-Interest Bonus if you conducted one of the following checking activities: One (1) direct deposit of $100.00 or more received in the previous 35 calendar days; Or your Fifth Third checking account must have (i) one (1) automatic checking transfer of $100.00 or more into a Fifth Third personal savings account during the previous 35 calendar days; AND (ii) total net transfers from your checking to savings during the previous 35 days equal $100 or more; Or any combination of five (5) or more of the following checking activities in the previous 35 calendar days: Debit card purchases (signature or PIN); cleared check(s); Online bill payments done through www.53.com and/or Fifth Third Telephone Banking. Your Fifth Third checking account is considered "active" by satisfying any of the aforementioned requirements above. An Interest Bonus (equal to the amount of interest already earned in the current statement cycle) is paid to the account at the end of each statement cycle based on the previous 35 calendar days checking activity. Please request a Rate Sheet for the interest rates and annual percentage yields paid on this interest-bearing account. The interest rate and annual percentage yield may change. At the bank's discretion, the bank may change the interest rate and annual percentage yield at any time on your account. Your interest begins to accrue no later than the business day Fifth Third receives credit for the deposit of non-cash items (for example, checks). Interest on your account will be compounded continuously and credited monthly. Fifth Third uses the daily balance method to calculate interest on your account. This method applies a daily periodic rate to the balance in your account each day. If an account is closed before interest is credited, you will not receive any accrued interest. Interest is paid only on days when balance is $250 or above.

- Goal Setter Savings (Double Interest Bonus): The one-time cash bonus will be issued after your goal has been reached. The bonus is paid at the end of the first statement cycle where the account has been opened at least 185 days and the current balance is equal to or greater than the goal amount (a $500 goal minimum is required, a $25,000 goal maximum is allowed). The bonus amount is equal to the total interest earned on the account from the open date to the date the bonus is paid. View complete Goal Setter Savings product details and requirements to qualify.

$50 minimum deposit required to open all accounts.

* Subject to terms and conditions

† First annual fee is assessed at card opening and then on each open anniversary date, thereafter.

Each Package

Comes With

Real Life RewardsSM Credit Card

Earn meaningful rewards designed for your lifestyle with no annual fee and a low introductory rate.

Relationship Savings

Double the interest. Zero the hassle. Get a double-interest savings bonus for doing your everyday banking.