Prepare for Your Future

With Education and Retirement Investment Strategies

Some goals are too important to leave to chance.

You have hopes for your future, which is why we view investing as more than just numbers. Your investment strategy should be a roadmap toward the future you desire. Do you dream about watching your children receive their college diplomas? We can help you set up college savings accounts. Are you thinking ahead toward the time you leave the work force? We can assist you with retirement investment strategies. Or, are you investing with other goals in mind?

When you turn to Fifth Third Securities, you receive personalized investment guidance based on what you want to achieve, whether you need retirement investment strategies or college savings accounts. You will work with a team of experienced Investment Professionals who take the time to understand your personal goals, then assist you in developing an investment strategy tailored to help meet your specific needs and risk preferences.

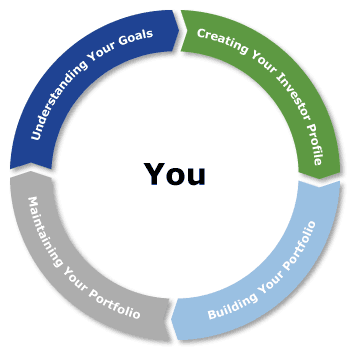

The Fifth Third Securities process for helping you develop an investment strategy:

Throughout the entire Fifth Third Securities process, our focus is on continuously evaluating whether your goals are still in line with your life and the financial situation you desire.

Get Advice and Guidance

For retirement investment strategies, college savings accounts or other investment strategies, contact a Fifth Third Securities Investment Professional, visit a Fifth Third Banking Center near you, call us toll free at 1-800-416-8714, or fill out a contact form.

Fifth Third Securities is the trade name used by Fifth Third Securities, Inc., member FINRA/SIPC, a broker-dealer and an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Fifth Third Securities is a wholly owned subsidiary of Fifth Third Bank. Securities and investments offered through Fifth Third Securities, Inc. and insurance products:

| Are Not FDIC Insured | Offer No Bank Guarantee | May Lose Value |

| Are Not Insured by any Federal Government Agency | Are Not A Deposit | |

Insurance products made available through

Fifth Third Insurance Agency, Inc. | Business Continuity

Getting on the right path begins by meeting with your Fifth Third Securities Investment Professional to discuss your current financial situation, family, goals and aspirations.

Your individual needs form the basis of an asset allocation strategy for your portfolio, and selecting from a variety of asset categories gives you a better opportunity for a successful investment strategy.

With your portfolio in place, your Investment Professional continues to review financial options to help your portfolio stay on course for your future.

Even with a strategy established and in place, our involvement does not end. Instead, we monitor and evaluate your plan's progress to determine if it is accomplishing your goals.