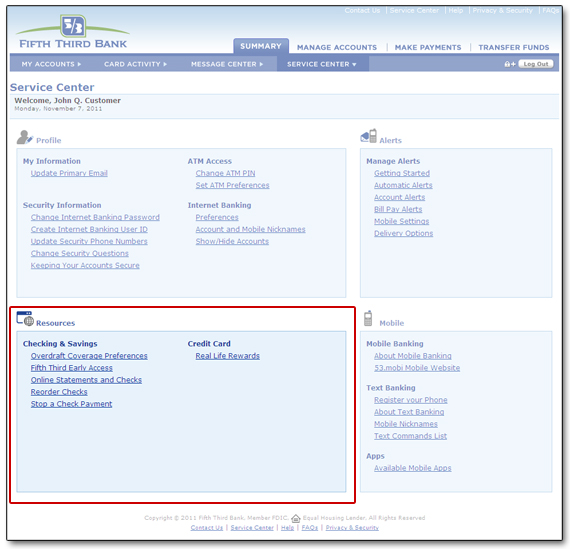

Resources

The Resources section of the Service Center allows you to set options related to your specific accounts.

Checking and Savings includes such items as:

- Overdraft Coverage Preferences

- Fifth Third Early Access

- Online Statements and Checks

- Reordering Checks

- Stopping a Check Payment

Credit Card:

- Real Life Rewards

Overdraft Coverage Preferences

Overdraft Coverage for your ATM transactions and everyday Debit Card purchases is a choice you must make for your checking account(s). You can now easily manage your Overdraft Coverage preferences on any of your checking accounts. Furthermore, you may change your preference for Overdraft Coverage at any time.

To learn more, visit our Account Management Services online tutorial or FAQs, review the Overdraft Coverage Disclosures document or visit a Fifth Third Banking Center.

If you would like to update your Overdraft Coverage Preferences for any checking account(s) listed on the Overdraft Coverage page, select Edit Preferences. You will be asked to select the Overdraft Coverage preferences for each account listed. If you click Yes, you will need to review and agree to the Overdraft Coverage Disclosures. Once you've made your choice(s), click on the Continue button.

Confirm your changes to your account(s) and click on the Continue button. You will have the ability to print your changes for your records.

Fifth Third Early Access

Fifth Third Early Access is a short-term form of credit that allows eligible Fifth Third personal checking customers to take an advance on their next qualified direct deposit.

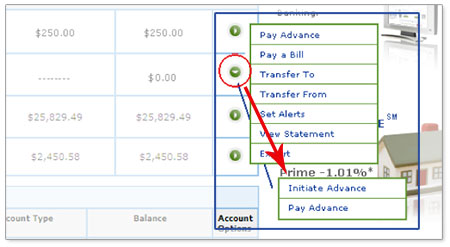

Initiate an Advance

From the My Accounts page, mouse over the ![]() icon for Fifth Third Early Access and select Initiate Advance from the Account Options menu. Fifth Third Early Access will be included with Deposits/Investments. (see below)

icon for Fifth Third Early Access and select Initiate Advance from the Account Options menu. Fifth Third Early Access will be included with Deposits/Investments. (see below)

- On the Initiate Advance page, you will be prompted to enter a valid whole dollar amount that does not include change (e.g. $150.00 is valid, but $150.21 is not). The dollar amount can't exceed your Available Credit Limit. Click the Next button.

-

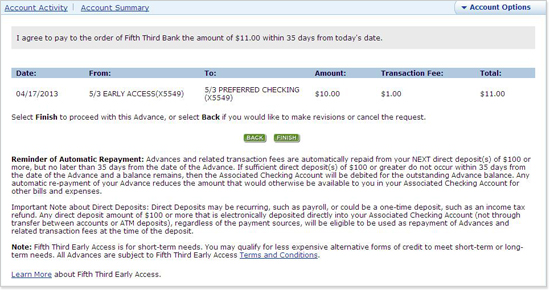

Review the advance information. If the information is correct, click the Finish button to confirm your advance. You will then receive a final confirmation with an advance ID number. Click the Back button to make changes or cancel the request. (see below)

- Select the OK button to be directed back to the Fifth Third Early Access Account Activity page.

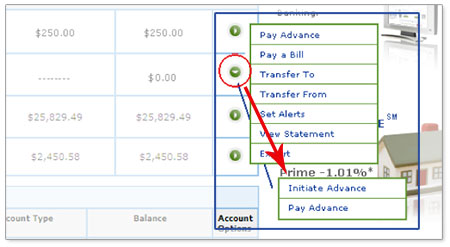

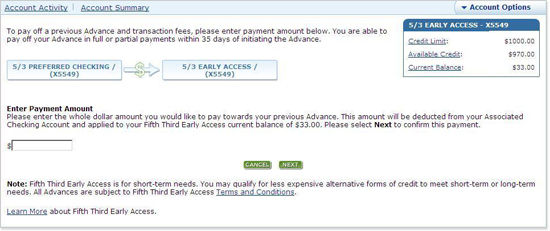

Pay Advance

- From the My Accounts page, mouse over the

icon for Fifth Third Early Access and select Pay Advance from the Account Options menu. Fifth Third Early Access will be included with Deposits/Investments. (see below)

icon for Fifth Third Early Access and select Pay Advance from the Account Options menu. Fifth Third Early Access will be included with Deposits/Investments. (see below)

- On the Pay Advance screen, enter the dollar amount you wish to pay back to your Fifth Third Early Access and select the Next button. This amount will be deducted from your associated checking account and applied to your current Fifth Third Early Access balance.

- Review the payment information. If the information is correct, click the Finish button to confirm your payment. You will then receive a final confirmation with a reference ID number. Click the Back button to make changes or cancel the request.

- Select the OK button to be directed back to the associated checking Account Activity page.

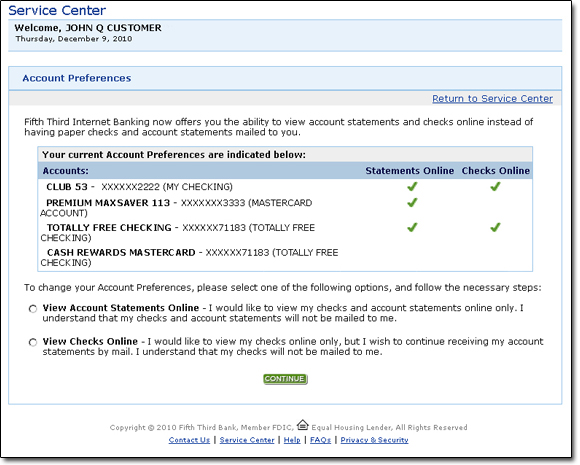

Online Statements and Checks

Select the Online Statements and Checks link to view your current account preferences and elect to receive your statements and checks online rather than through the mail. You will be able to elect online statements for your eligible checking, savings, and credit card accounts.

Your account preferences for each of your accounts are listed in the chart. If you are currently receiving statements or checks online, you will see a ![]() in the appropriate column.

in the appropriate column.

To change your account preferences, you are given the option to View Account Statements Online including checks, or you can elect to View Checks Online only.

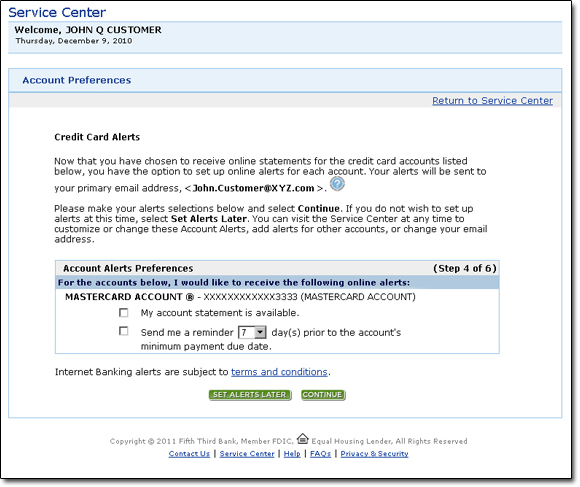

If you select to view a credit card statement online you will be given the option to set alerts for your credit card account(s).

Select the checkbox next to each alert to activate the alert. You can customize the payment due reminder. The input fields allow you to specify the number of days to be notified prior to your payment due date.

Select Continue to confirm your changes.

If the primary email address displayed is incorrect, it can be changed by selecting Manage Alerts in the Service Center under Account Services.

Please note: The first time you set up an alert, you will be prompted to accept the Internet Banking Alerts Terms and Conditions.

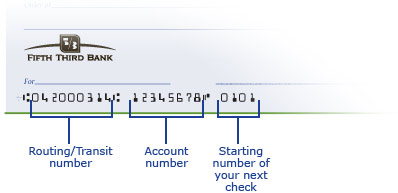

Reorder Checks

Select the Reorder Checks link found in the Service Center to go to Deluxe online check reordering. Check reorders will be sent to the mailing address on your account and a charge for the order will appear on your account. To reorder checks you will need your:

- Routing/Transit number

- Account number

- Starting number of your next check

In certain situations, checks cannot be reordered online. Please visit a Fifth Third Banking Center near you to complete your order if:

- There are any changes to your check order, such as name change or change of address

- It has been longer than two years since your last check order

- This is your first time ordering checks with Fifth Third Bank

Stop a Check Payment

You may request stop payment services for a check that has not already been accepted by Fifth Third Bank for processing. Please be sure to review your Account Activity to determine if your check has cleared before submitting a request. Upon your request, a stop payment order will be in effect for six months, and a fee of $33.00 will be charged to your account. The Bank will honor only the exact information given to us; otherwise the Bank is not responsible. Requests submitted after 10:00 p.m. ET will be processed the following business day.

To place a stop payment on a check, you will need to provide the following information:

- Account the check was written from

- Check number

- Exact check amount, including dollars and cents

- Name of the Payee

- Date written on the check

Note: This request does not apply to online bill payments. For help with electronic payments, please call a Customer Service Professional at 1-800-972-3030 or visit Contact Us to send a secure message.

Real Life Rewards

To view your points balance, visit the Real Life Rewards Center. Click on Real Life Rewards under Account Services within the Service Center. Your Fifth Third cards with active rewards points and point balance will be displayed. Learn more about Real Life Rewards.

Redeem Points

To redeem your points, visit the Real Life Rewards Web site.

Add Real Life Rewards to a Card

- To add Real Life Rewards to a card, visit the Real Life Rewards Web site, call 800-972-3030 or visit your nearest Fifth Third Banking Center today.

- Real Life Rewards come automatically on Fifth Third Equity FlexlineSM cards. Simply activate your card and complete a signature purchase. Plus, you'll receive 5,300 bonus points with your first signature card purchase.

Equal Housing Lender

Equal Housing Lender